How does EMI calculation help in planning the home purchase? HDFC Bank’s EMI Calculator can help you calculate your loan EMI with ease. Principal loan amount is ₹10,00,000 and the Interest amount will be ₹4,05,703Ĭalculating the EMI manually using the formula can be tedious. The rate of interest (R) on your loan is calculated per month. Illustration: How is EMI on Loan Calculated? A longer loan tenure (for a maximum period of 30 years) helps in reducing the EMI. It includes repayment of the principal amount and payment of the interest on the outstanding amount of your home loan. What is Home Loan EMI?ĮMI stands for Equated Monthly Installment. It an easy to use calculator and acts as a financial planning tool for a home buyer. Home Loan EMI Calculator assists in calculation of the loan installment i.e. Calculate the EMI that you will be required to pay for your home loan with our easy to understand home loan EMI calculator. With our reasonable EMIs, HDFC Bank Home loan is lighter on your pocket. With a low-interest rate and long repayment tenure, HDFC Bank ensures a comfortable home loan EMI for you. with additional features such as flexible repayment options and top-up loan.

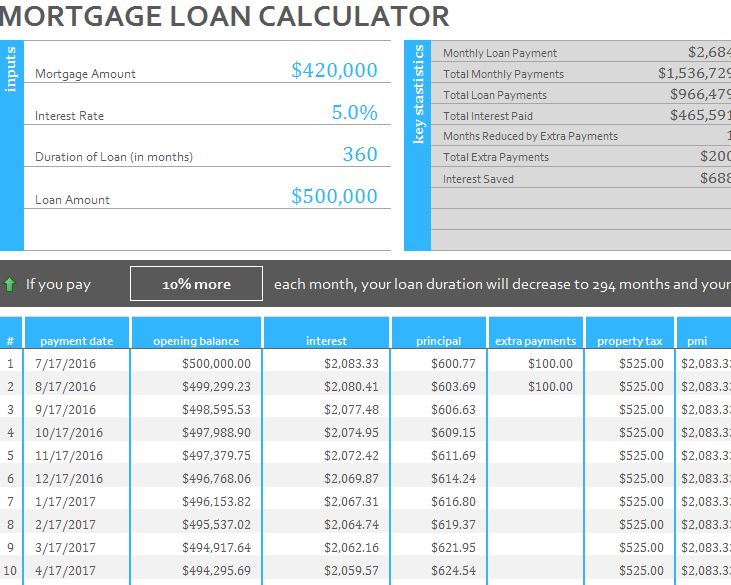

HDFC Bank offers home loans with EMIs starting from ₹769 per lac and interest rates starting from 8.50%* p.a. The EMI calculator is useful in planning your cashflows for servicing your home loan. HDFC Bank's EMI calculator for a home loan can help you make an informed decision about buying a new house. HDFC Bank's home loan calculator helps you calculate your Home Loan Emi with ease. We do not guarantee their accuracy, or applicability to your circumstances. Results depend on many factors, including the assumptions you provide. This does not include insurance or taxes or escrow payments.These calculators are provided only as general self-help Planning Tools. Monthly Payment the payment amount to be paid on this mortgage on a monthly basis toward principal and interest only. Note that this is the interest rate you are being charged which is different and normally lower than the Annual Percentage Rate (APR). Interest Rate the annual nominal interest rate or stated rate on the loan. Mortgage Term the original term of your mortgage or the time left when calculating a current mortgage Mortgage Amount the original principal amount of your mortgage when calculating a new mortgage or the current principal owed when calculating a current mortgage Mortgage calculator with taxes and insurance. To include annual insurance and taxes in your calculations, use this

Calculate your monthly mortgage payments on your home based on term of your mortgage, interest rate, and mortgage loan amount.

0 kommentar(er)

0 kommentar(er)